Giant Mining Corp. (CSE: BFG; OTC:BFGFF; FWB:YW5) is moving forward with the exploration and development of its Majuba Hill copper-gold-silver project in Nevada and its stock is arriving at strong support above its cyclical lows of last November and December as we will proceed to see later when we review its stock charts and is thus at a very point to buy as it is expected to form a Double Bottom with its November and December lows and reverse to the upside soon against the background of continued progress by the company and the ongoing bull market in copper.

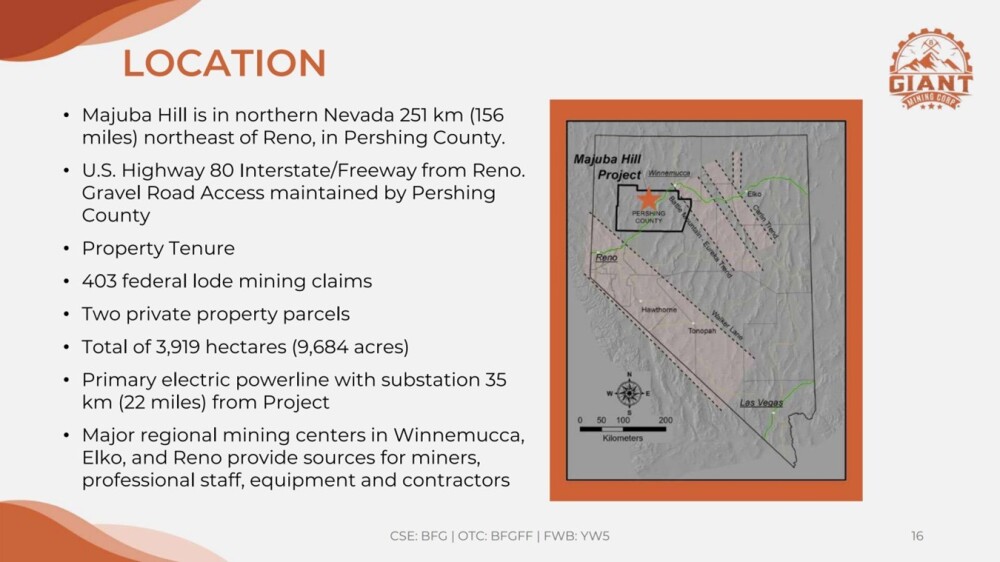

The company has a big flagship copper project, the Majuba Hill Project, that also contains gold and silver and is located northeast of Reno in the north of Nevada, as shown on the following page from the investor deck.

Being in Nevada, the local infrastructure is more than adequate.

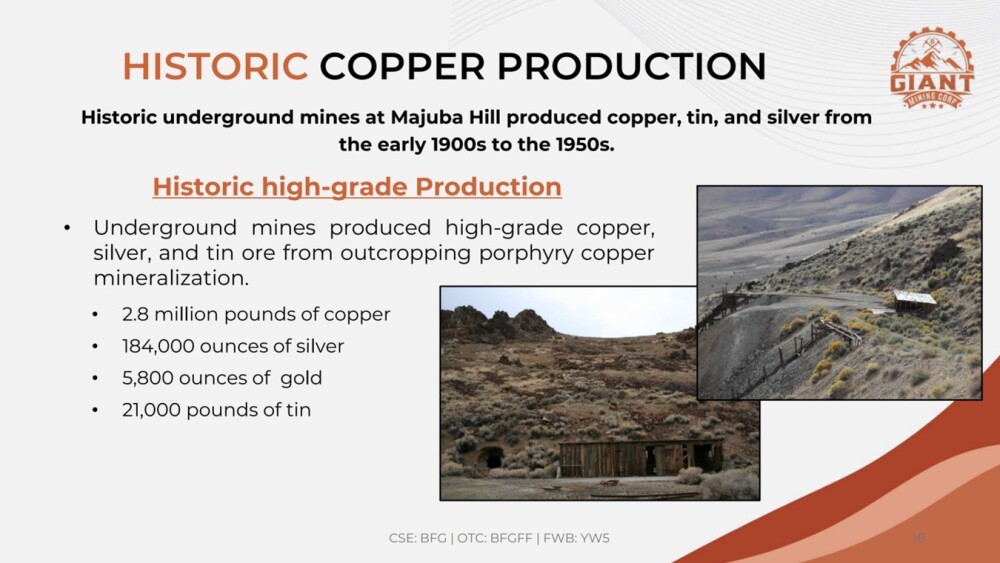

There is a history of high-grade production at Majuba Hill going back many years that was largely artisanal, which means that, using more efficient modern mining techniques, there are clearly economic deposits there, especially given that metal prices are now much higher. . .

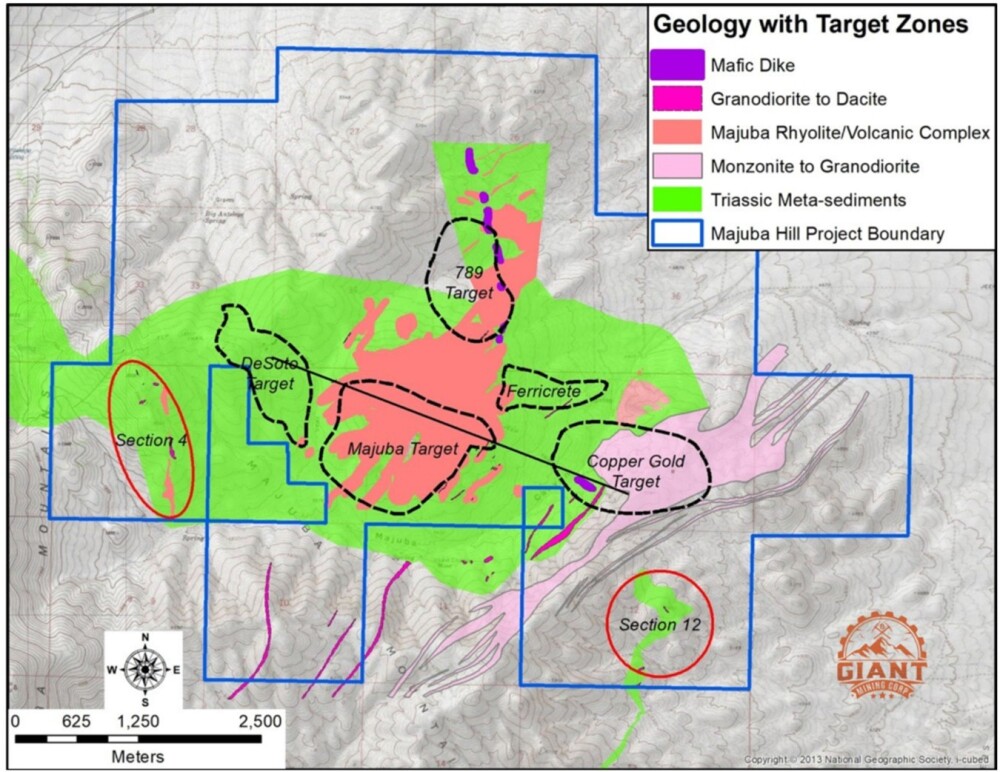

The following map shows the basic geology of the Majuba Hill Project and also the target zones:

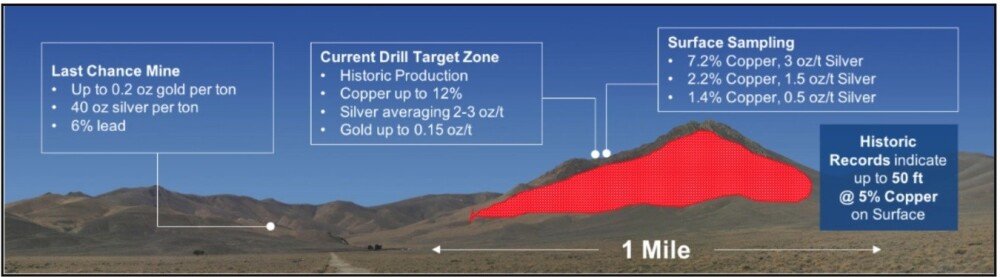

Below you will see the profile view of Majuba Hill:

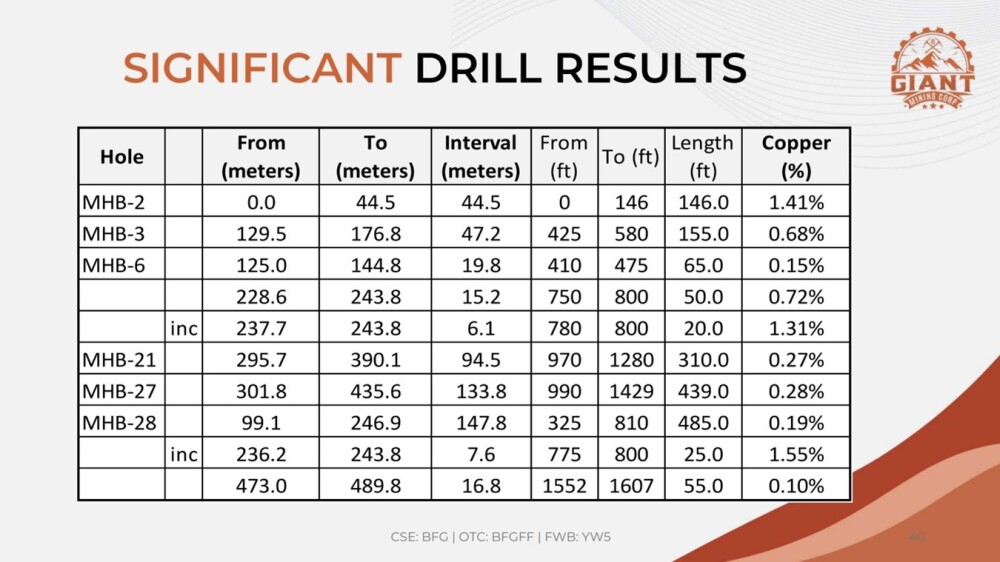

Significant drill results have been returned.

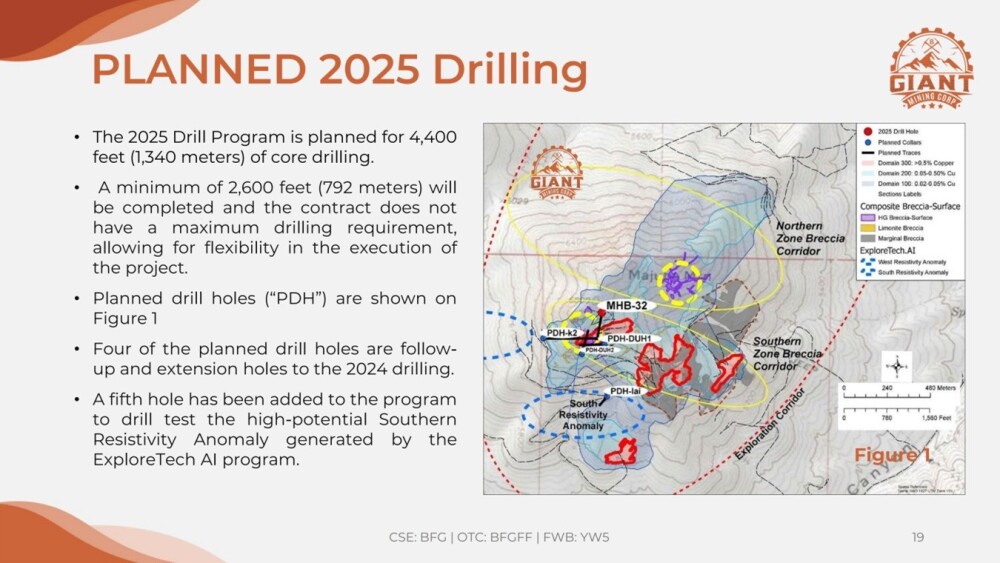

The next image presents details of this year’s planned drilling program.

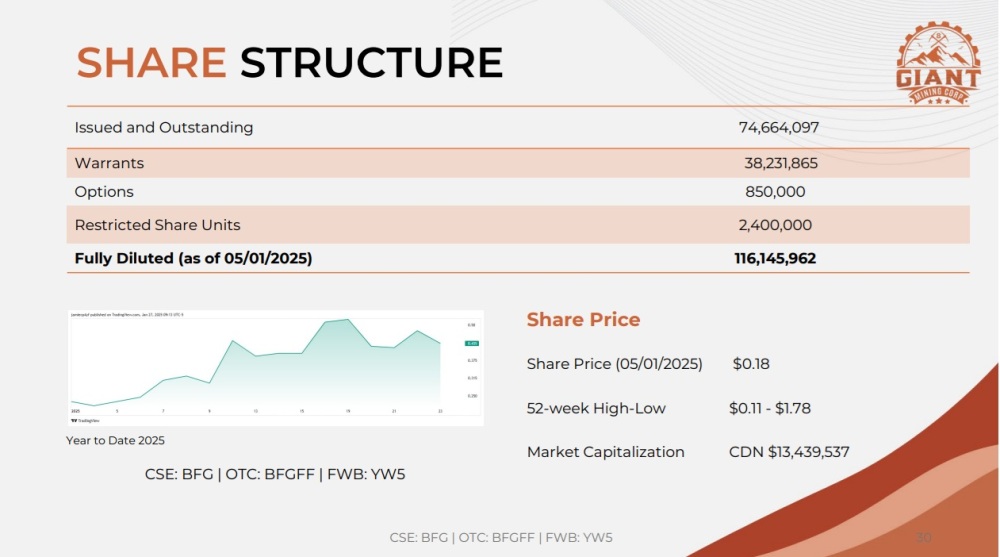

The last page shows the company’s share structure. According to the company itself, at the time of this article, there are 69.5 million shares outstanding.

Now, we will review the latest stock charts for Giant Mining.

We start with the long-term 5-year chart to remind ourselves that Giant Mining is historically very inexpensive here. It got almost to $140 early in 2021, probably adjusted for splits, and is now trading at around 17 cents. This obviously means that there is very little downside from here and potentially a lot of upside.

Although this chart is otherwise of limited use technically, we can see a big volume buildup over the past year which is interpreted as bullish because it shows that a lot of stock has changed hands during this period, which is viewed as positive because the sellers are mostly old stale holders of stock who, having understandably grown discouraged, have dumped their holdings at a loss but they have been replaced by new owners who generally will be much less inclined to sell until they have turned a profit, which has the effect of “locking up” stock, reducing the quantity available to buyers who have to bid the stock up.

On the 1-year chart, we can see that, early in the year, the setup looked positive with the Saucer pattern shown looking set to lead to a new bull market, especially as the advance away from the Saucer boundary in January had been driven by strong volume.

However, the pattern aborted late in February and in March for capital markets reasons, leading to the decline to its current price, and it now looks like the stock will make a Double Bottom with its November and December lows before advancing anew, and if so, we are at a very favorable point to buy now. Drill results are believed to be pending, and if favorable, they could, of course, get the stock moving higher.

Giant Mining is therefore rated a Strong Buy here, and this is a good point to add to positions. The first target for an advance is CA$0.30, and the second is CA$0.60, with much higher targets once the latter is attained.

Giant Mining Corp.’s website.

Giant Mining Corp. (CSE: BFG; OTC:BFGFF; FWB:YW5) closed for trading at CA$0.175, US$0.1186 on May 1, 2025.

| Want to be the first to know about interesting Base Metals and Critical Metals investment ideas? Sign up to receive the FREE Streetwise Reports’ newsletter. | Subscribe |

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund’s opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund’s opinions on the market and stocks cannot be construed as a recommendation or solicitation to buy and sell securities.