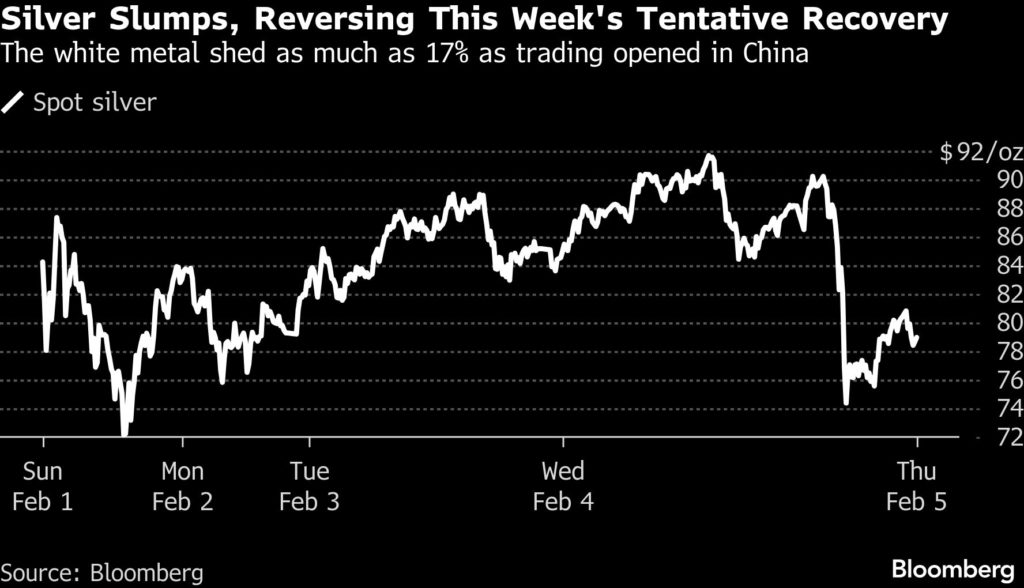

Silver plunged sharply on Thursday to a one-month low as the metal continues to face severe volatility after its parabolic run.

Spot price fell more than 15% to around $75 an ounce by midday trading in New York, wiping out its entire gains from the past two sessions.

The rout started during the Asian trading hours and extended into the New York market open, mirroring the historic crash seen last Friday.

Silver has risen by more than 130% over the past year amid growing demand for the metal from industries as well as investors looking to pile into safe-haven assets.

China, in particular, saw a massive surge in speculative buying, taking prices on a parabolic run since late 2025. Investors elsewhere also built up large positions in precious metals throughout January.

However, that rally hit an abrupt halt at the end of last week, when silver saw its worst ever daily drop. That selloff continued into the early part of this week, and prices have continued to be exceptionally volatile since then. Silver is now trading at 35% below last month’s all-time high of $121.64 per ounce.

Speculation, particularly in China, “is wreaking havoc on the price discovery process for bullion,” Metals Daily CEO Ross Norman wrote in a note Thursday. Volatility in precious metals has become self-sustaining, removed from the real market and its drivers, he added.

Meanwhile, gold fell around 3% to the $4,800-an-ounce level, and is now down 10% since the Friday crash.

Volatility to remain

Due to its smaller market size, silver has always been more volatile than gold. Analysts predict that the high volatility seen in the silver market is likely to persist due to the spike in speculative inflows.

“Silver has entered a highly flow-driven phase, with price action dominated by speculative and CTA positioning rather than physical fundamentals,” said Daria Efanova and Viktoria Kuszak of Sucden Financial.

Despite ongoing structural tightness, silver’s high beta and strong macro linkage leave it vulnerable to sharp corrections at elevated prices, according to the Sucden analysts.

“Volatility is likely to remain pronounced, with upside dependent on renewed inflows and downside limited but uneven, as positioning shifts continue to drive exaggerated moves,” they added.

According to Bloomberg strategist Mark Cranfield, traders will be watching for this week’s nadir just above $71, though the $70 mark is “arguably more significant.”

“The precious metal hasn’t been in the $60s range since December and a return to that range will deepen the risk aversion mood across assets,” he said.

(With files from Bloomberg)