Gold is holding on but it should have a big fall in the expected C wave that should take it down to or below US$3,000.

It has been a great run, so profit taking has been appropriate amongst those stocks with large built-in gains.

Note that volumes at the highs are large and now represent overhangs.

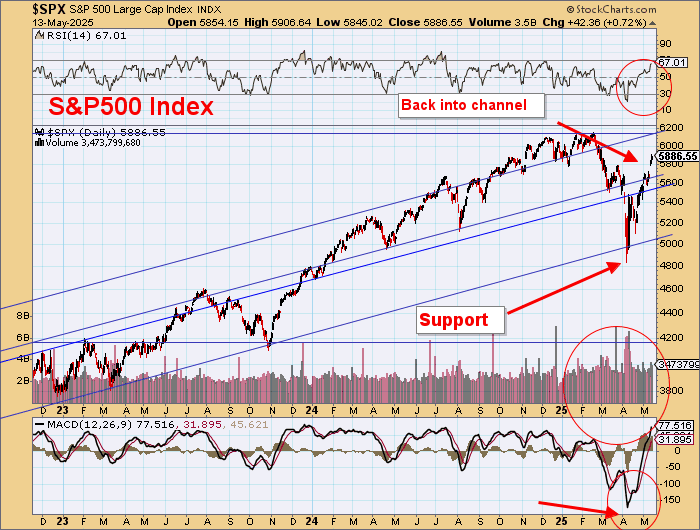

Broken parabola — likely to break channel line:

Testing 179 but heading to 165:

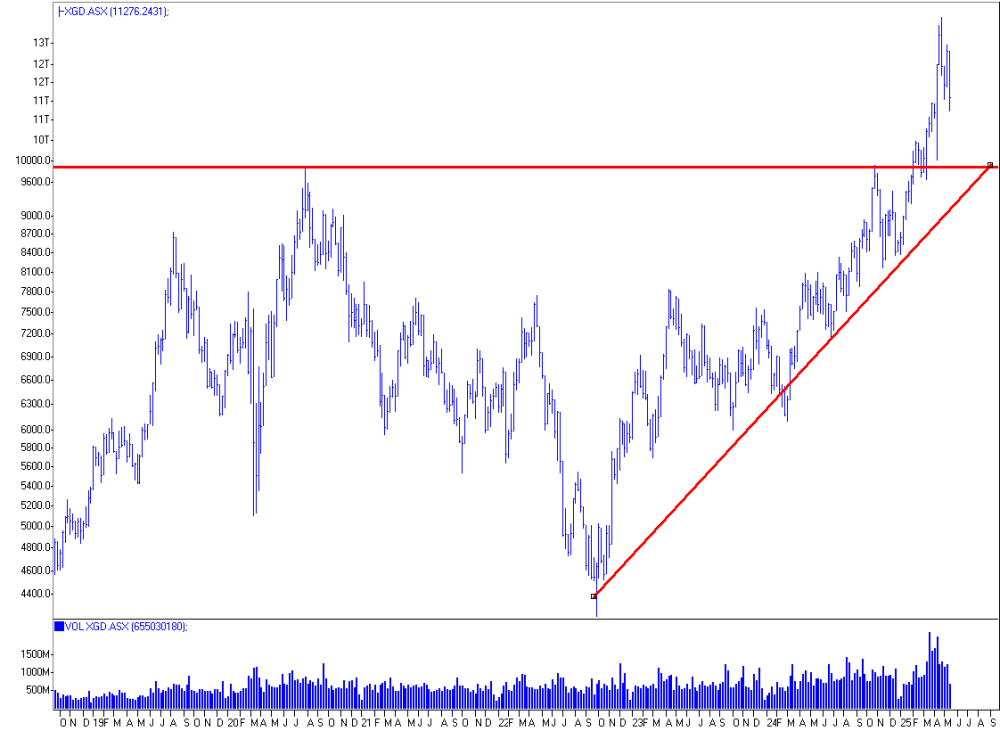

ASX Gold Index

- Peaked at 13,132 on 22 April

- Now 11276

- Heading back to test the previous highs at ~10,000.

- Still 10% downside in this C wave.

XGD 2018-2025:

US Bonds

Yields are still lower than a month ago.

And lower than 18 months ago.

Another island reversal?

Yields have been falling for >18 months.

US Boom in 2026.

Larry Kudlow and Newt Gingrich are talking here.

It’s worth watching!

Nice move higher, but gap needs to be filled at some stage:

Uptrends are strong:

Head the markets!

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports’ newsletter. | Subscribe |