Copper prices surged nearly 6% on Monday, supported by investor concerns over potential US tariffs on the industrial metal and a weaker dollar.

The rally followed US President Donald Trump’s announcement late Friday that he plans to double tariffs on steel and aluminum to 50% starting this Wednesday.

The threats raised concerns over the fate of copper, which the Trump administration is also considering placing tariffs on. Prices of copper in the London and New York markets gapped up on the news.

Benchmark three-month copper on the London Metal Exchange (LME) was up 0.7% at $9,572 per metric ton as of 07:06 GMT.

On the COMEX, copper for July delivery rose 5.8% to $4.94 per pound ($10,887 per tonne).

China’s commodity markets were closed on Monday for the Dragon Boat Festival holiday.

Meanwhile, the dollar edged lower as markets assessed the potential growth and inflation risks stemming from Trump’s latest tariff policy.

China’s manufacturing activity contracted in May for a second consecutive month, according to an official survey released Saturday, fueling expectations of further stimulus to support the economy amid a protracted trade war with the US.

(With files from Reuters)

Copper and the new resource spheres of control

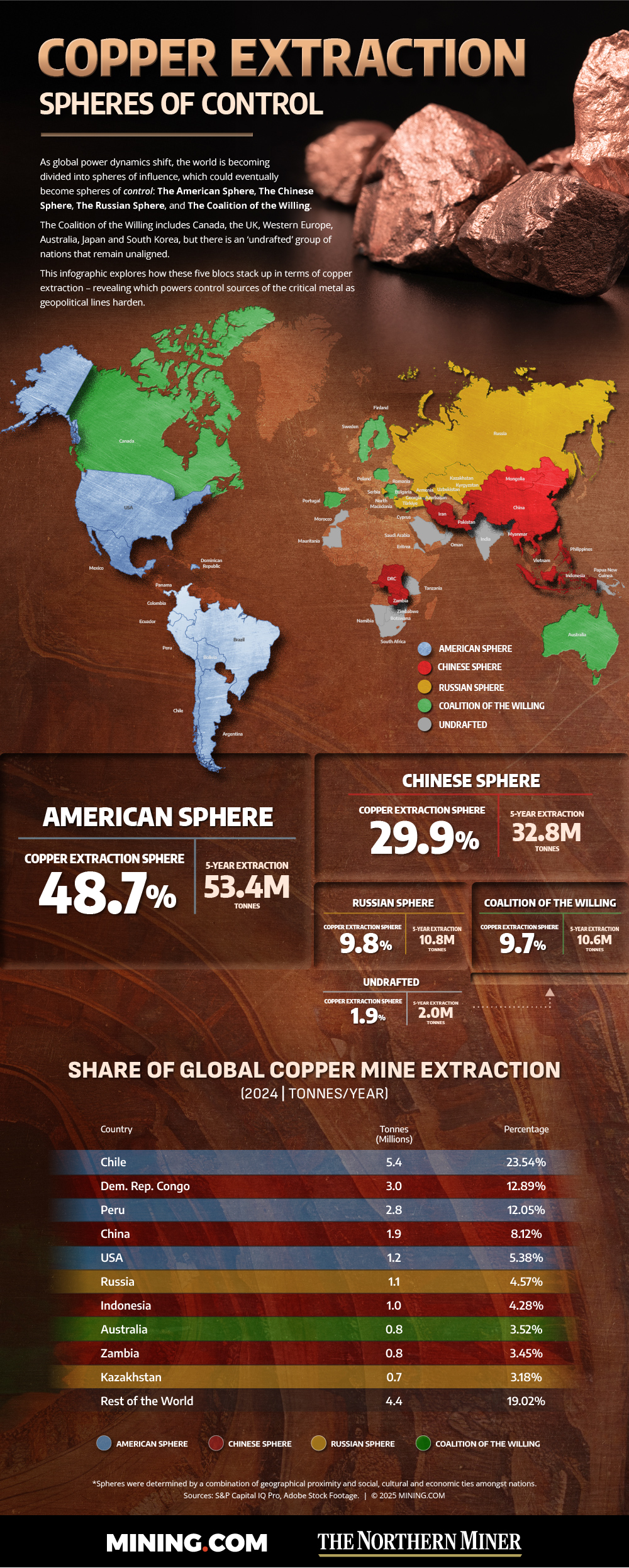

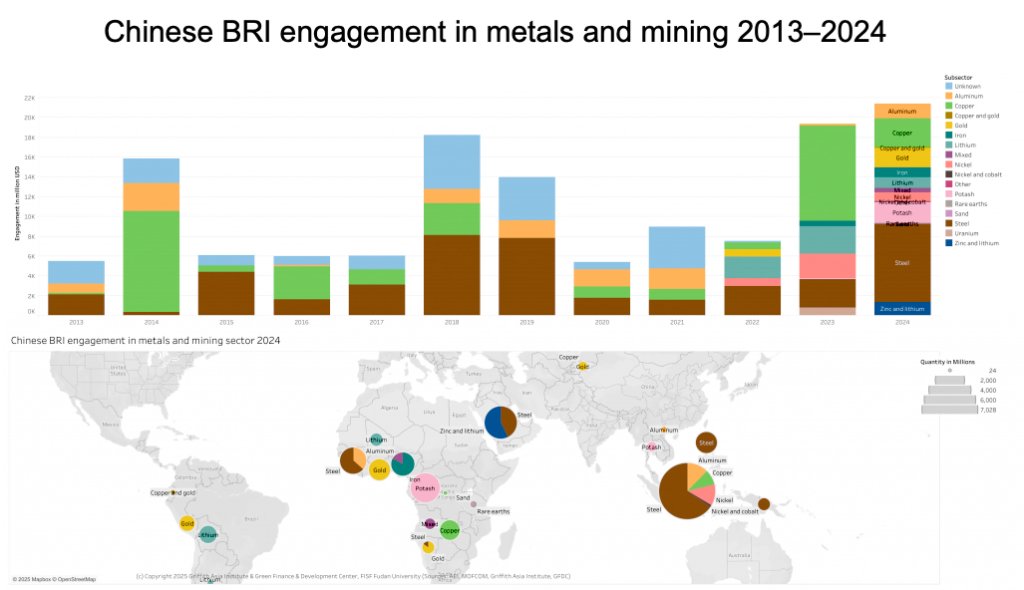

MINING.COM and The Northern Miner mapped global copper production through a geopolitical lens, dividing the world into five “spheres of control”: American, Chinese, Russian, Coalition of the Willing, and Undrafted.

These groupings reflect geographic, social, cultural, and economic ties—as well as potential alignments in an increasingly polarized world.