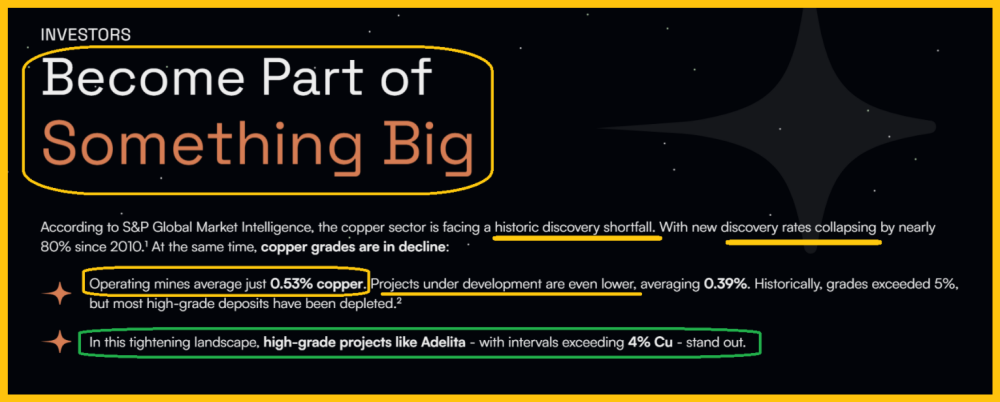

Algo Grande Copper Corp. (ALGR:TSX.V)is a North American exploration company that is advancing the Adelita project.

This project is anchored by the high-grade Cerro Grande Skarn discovery zone in the Sonoran-Arizona Porphyry.

By leveraging new technology and a world-class technical team behind multiple billion-dollar discoveries, the company is committed to both responsible development and fast-tracking resource definition to create lasting value for stakeholders.

Leadership

Enrico Gay, CEO, is a capital markets professional. He’s a key contributor to both Kenadyr’s reactivation as Algo Grande Copper Corp. and the acquisition of the company’s flagship Adelita project.

Strategic Advisor Dr. Peter Megaw, world-renowned CRD expert and co-founder of MAG Silver brings decades of discovery success and a proven track record of turning early-stage projects into billion-dollar assets.

Dr. Megaw’s firm, Megaw Exploration Associates, MXA, acts as the company’s operational “on the ground” partner, providing end-to-end support, from geological modeling and target generation to drill planning and project evaluation.

Dr. Megaw’s Adelita project video update is here.

AGM (Annual General Meeting) News

The Algo Grande Copper Corp. AGM is scheduled for February 25, and Dr. Raymond Jannas has been nominated to become a director (pending AGM approval) at that time.

Dr. Jannas is an economic geologist with 40+ years’ experience in porphyry Cu-Au systems. He has contributed to discoveries including Pascua-Lama, El Morro, and Valeriano. He’s a former ATEX CEO, has a Harvard PhD, and is now advising Algo Grande on Adelita.

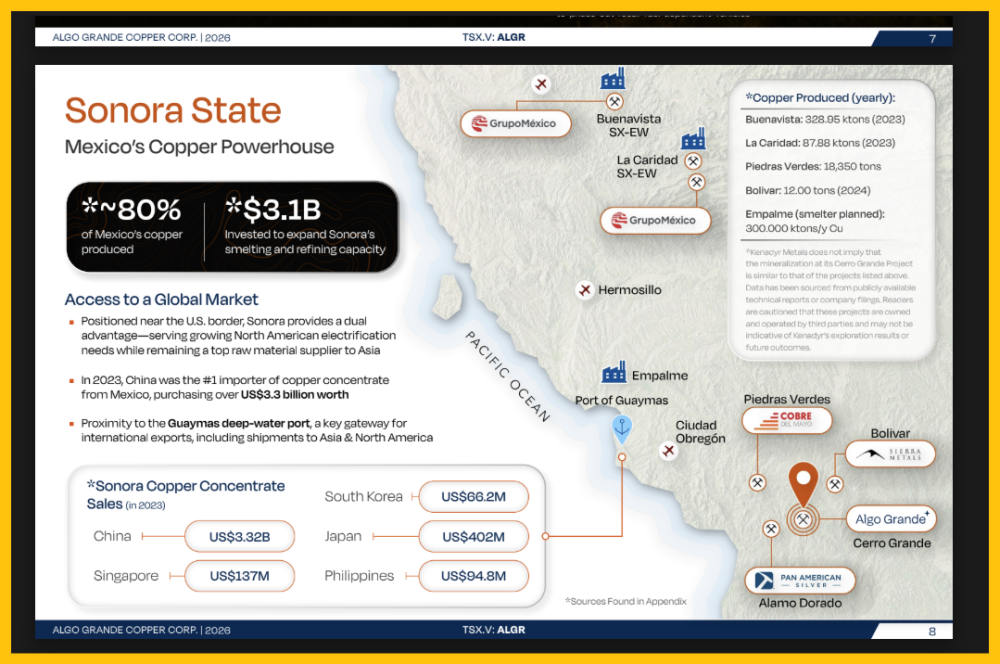

The Sonora Advantage

The Sonora state is near the U.S. market, and numerous producers are in the region. Roads and power are available, which is a big factor in the cost of production.

A shipping port is also close at hand.

All that’s needed now is more great drill results, and the company has announced a financing to try to get that job done.

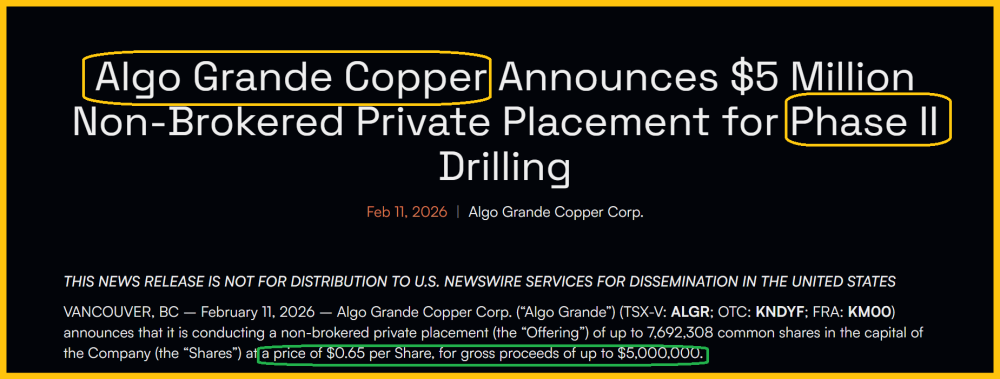

New Financing for a Phase Two Drill Program

The stock closed at CA$0.72 on Friday, February 16, above the private placement price of CA$0.65.

From a technician’s viewpoint, that’s a sign of near-term strength for the stock.

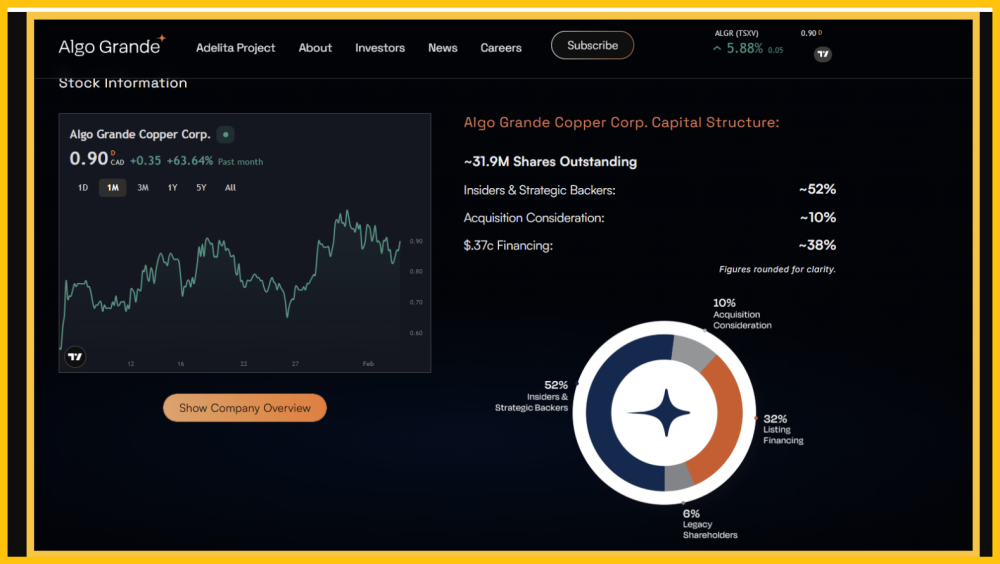

Strong Hands Hold the Stock

The company’s limited number of shares outstanding is impressive… and so is the percentage of insiders/strategic investors holding the stock.

Technical Analysis: Buy Zones & Price Targets

Here’s a look at the short-term chart:

There’s a significant bull wedge in play and a bullish divergence with the price for both the RSI and Stochastics oscillators.

The next news announcement should be the catalyst for the bull wedge breakout and surge to my CA$1.00 short-term target zone… but the chart action is so bullish that it could happen before there’s any news.

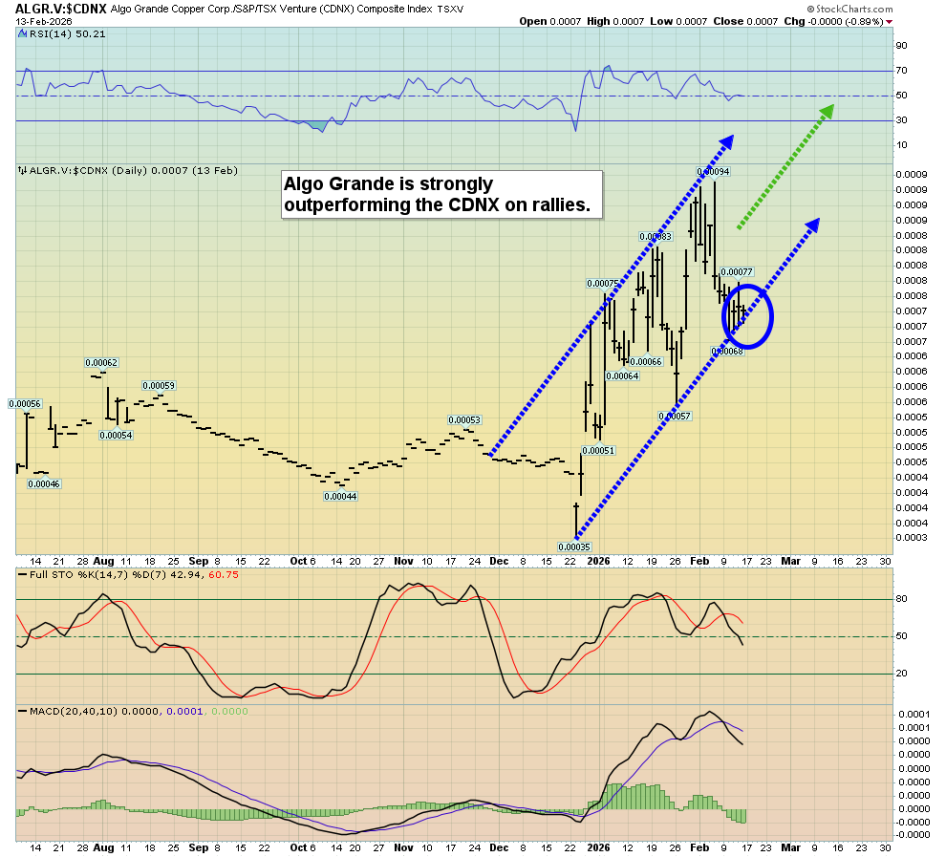

Here’s a look at the price action of the stock compared to the CDNX index:

As noted, the stock is outperforming the CDNX index since the company did the Adelita acquisition and name change.

With a new heavyweight strategic advisor potentially about to join the board, investors should expect to see this kind of outperformance… and they are getting it.

The company’s detailed investor presentation is available here.

You can see my last article on Algo Grande here.

- Stock price at time of writing: CA$0.72

- Short-Term Technical Price Target: CA$1.00

- Long-Term Technical Price Target: CA$6.00

- Technical Rating: Speculative Buy

- Company Website: https://algo-grande.com

| Want to be the first to know about interesting Gold and Copper investment ideas? Sign up to receive the FREE Streetwise Reports’ newsletter. | Subscribe |