The U.S. government is desperately trying to talk the outrageously overvalued stock market up again. The macabre hope of the government, sadly, appears to be to restore investor confidence in chasing the market into a state of even greater overvaluation than already exists now.

Here’s a look at the horrifying level of overvaluation, basis the CAPE/Shiller index (inflation-adjusted PE ratio):

From 1880 to 1980, the U.S. stock market was rarely overvalued, basis a CAPE ratio of 20 or more.

Now?

Now it’s almost always overvalued and rarely undervalued. The problem of course is . . . debt.

Gold has taken a hit this week, as the government tries to restart the “risk-on” theme.

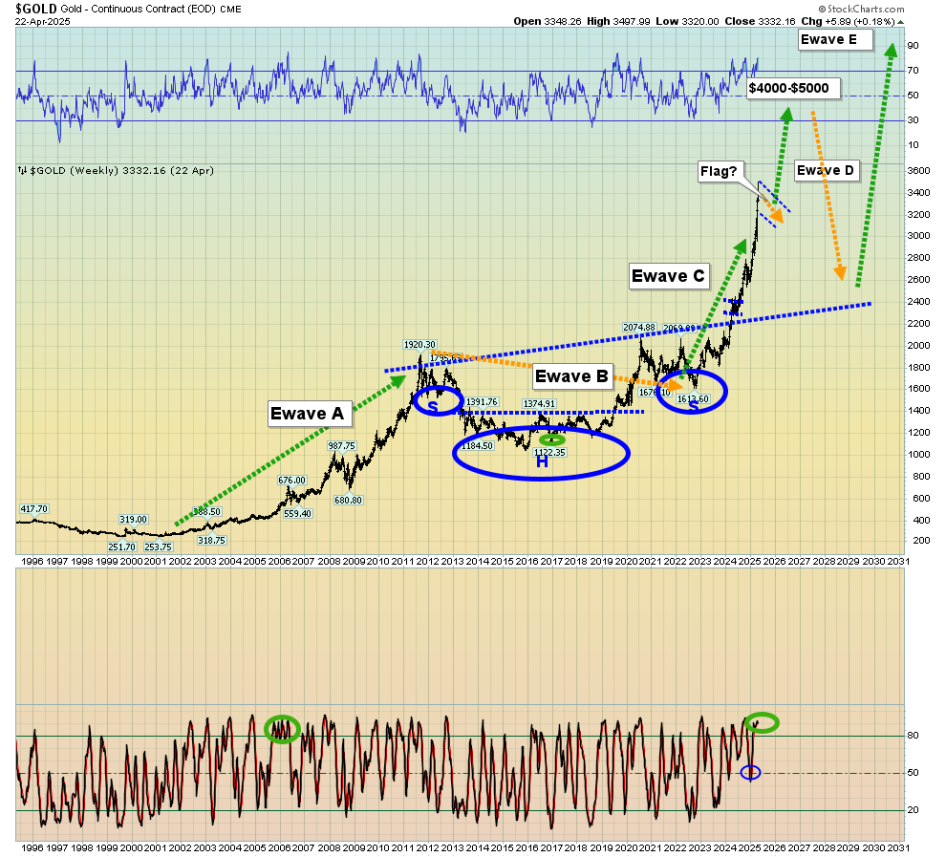

Here’s a look at gold on the weekly chart:

Note the Stochastics oscillator at the bottom of the chart. The pullback for gold was technically due and of course investors are eager to find out what might be next.

The key retracement zones are $3250 (a good buy zone for gold stock gamblers), $3150, and $2950. Those latter two zones are good zones for conservative investors to buy.

They are support and also loosely correlate to key Fibonacci retracement numbers . . . retracements of the entire rally that began with the year 2022 break out from the huge C&H pattern at about $2000.

Here’s a look at another weekly chart for gold, from an Elliott “Big Wave” perspective:

Wave C (3) is likely to end with a massive price surge out of a bull flag that appears to be forming now… and into the $4000-$5000 zone!

Interestingly, from an Elliott perspective, the correction for gold stocks may be over sooner, and no correction is forecast for silver!

Here’s a look at the daily silver chart of the SIVR ETF:

The gold/silver ratio touched round number 100, and silver is surging today . . . with gold down $100/oz!

Silver is a great way for the “little metals guy and gal” to play my 40year inflation cycle theme. I’ll talk more about that cycle in coming updates.

One gold stock that received massive junior mining stock analyst coverage in years gone by . . . and by me now . . . is Novo Resources.

Here’s a look at the daily chart:

I’ve been suggesting the stock can be accumulated in the sub 15 cent zone.

Novo was so widely followed in the past that even a small rally should generate enough momentum to push it to $1.00, even if all that the management hoped would happen . . . never does.

I’ll be covering more key junior miners in more frequent updates in the weeks ahead. The bottom line is that “good” (for the miners) stagflationary times are here, and even better ones are near!

Special Offer for Streetwise Readers: Please send me an Email to [email protected] and I’ll send you my free “Silver Stocks: Set To Get Hot?” report. Silver stocks tend to rally dramatically in the final stage of a gold market surge. I highlight the SILJ junior silver stocks ETF, and key component stocks that appear set to surge!

I write my junior resource stocks newsletter about twice a week, and at just $199/12mths it’s an investor favourite. I’m doing a special pricing this week of $169 for 14mths. Click this link or send me an email if you want the offer and I’ll get you onboard. Thank-you.

| Want to be the first to know about interesting Gold and Silver investment ideas? Sign up to receive the FREE Streetwise Reports’ newsletter. | Subscribe |

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line: