Brinkmanship everywhere.

Bond yields failed to rise despite all the gold bugs wanting them to surge.

That upward sloping wedge was breached to the downside.

Still think a major bond rally is about to start.

Would send the stock market much higher.

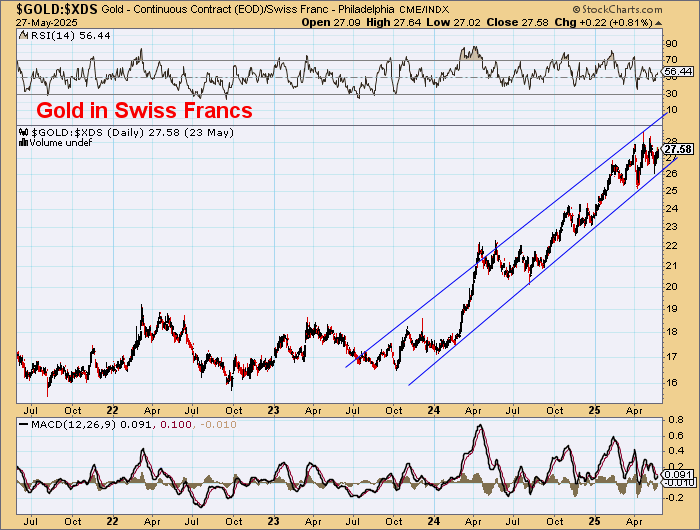

Gold has back tested its short term parabola breach so it could come lower now.

A potential “flag” is developing in US$ gold but it might not work out that way.

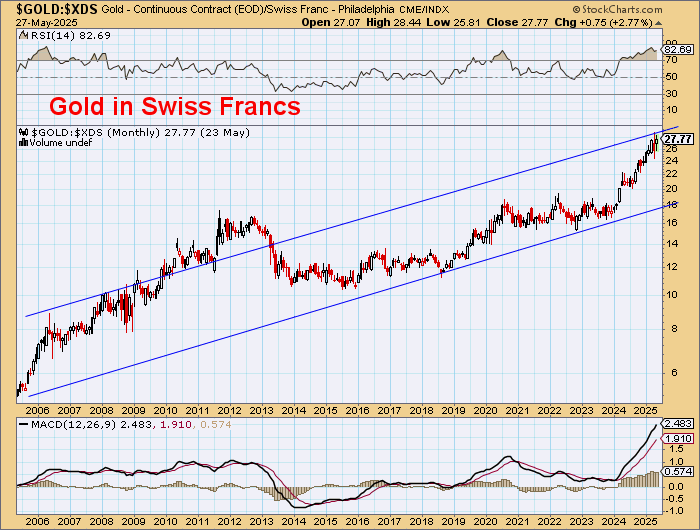

Looking at gold in other currencies is not giving much of a clue to the next move but in looking at the Yuan gold price it is no wonder Chinese have been big buyers.

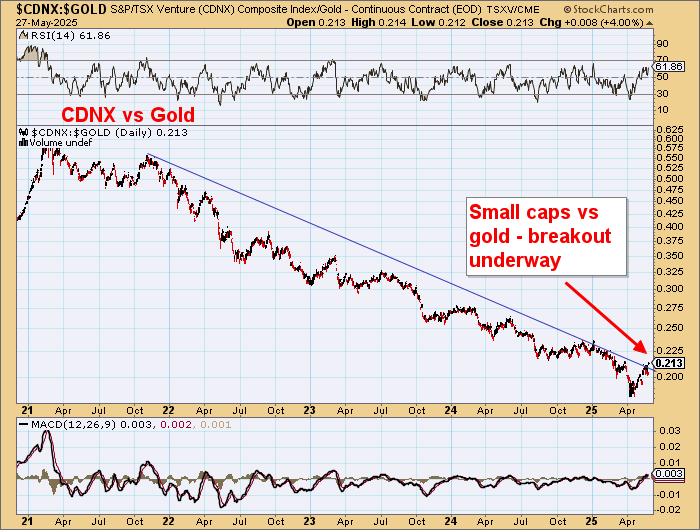

Small cap resources are now starting to fire and that CDNX Index continues to move higher.

That S&P600 Small cap index is completing a reverse H&S reversal and will soon head higher quite rapidly.

Small is good!

The white precious metals are moving higher with a break out by platinum leading palladium higher.

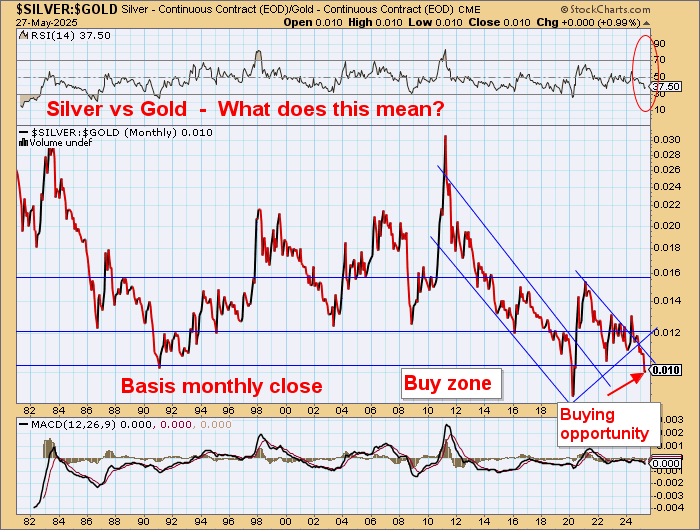

Silver is trading at just 1% of the price of gold.

Interesting times.

Hard to make a case to be bullish or short term cautious looking at these gold prices in other currencies.

SILVER

Silver is just 1% of the gold price or 100:1 Silver:Gold ratio.

WHITE PRECIOUS METALS

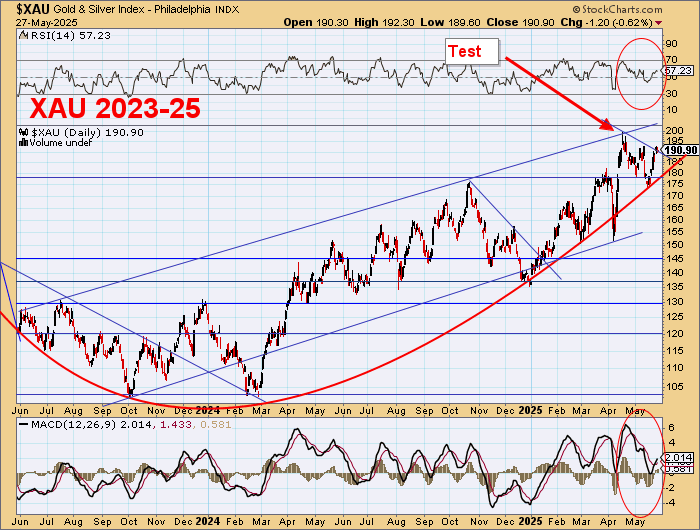

GOLD STOCKS

XAU: Will this move higher now?

The heavyweight gold producers have been a real disappointment but maybe they are improving technically.

But it is the small caps that are building momentum.

BONDS

That upward sloping wedge on the 10 year was breached.

Island reversal on the five-year.

A lower interest rate regime would send the stock market much higher.

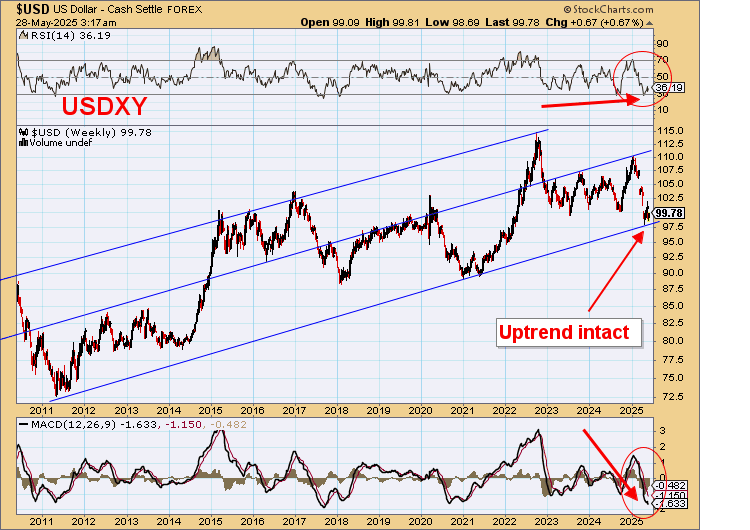

US$

Still in uptrend.

Heed the markets!

| Want to be the first to know about interesting Gold, PGM – Platinum Group Metals and Silver investment ideas? Sign up to receive the FREE Streetwise Reports’ newsletter. | Subscribe |