United States Antimony (NYSE-A: UAMY) and Americas Gold and Silver (TSX: USA; NYSE-A: USAS) are joining forces to build a hydromet processing plant in Idaho that they see anchoring a domestic supply chain of critical minerals.

The plant, to be built in Idaho’s Silver Valley next to active silver, copper and antimony mines owned by Americas Gold, will process antimony feed material from the Toronto-based miner’s permitted Galena complex, according to separate statements issued Tuesday. It will also have the potential to process feed from other sources. Galena produced 561,000 lb. of antimony last year.

“We view this as a positive update as it’s in line with Americas Gold and Silver’s strategy of unlocking value of its antimony production as the only antimony producer in the US,” Desjardins Capital Markets mining analyst Allison Carson said Tuesday in a note.

Americas Gold will control 51% of the joint venture, compared with 49% for US Antimony, with the latter serving as the managing member, the companies said. All major decisions will be made by a newly formed committee of equal representation from both partners.

Greater control

The partnership’s main objective is to exert greater control over the processing necessary for copper, silver and antimony – the three primary critical minerals being mined by Americas Gold. The partners want to generate greater overall recoveries at a “significantly” lower cost, which would boost the venture’s profitability.

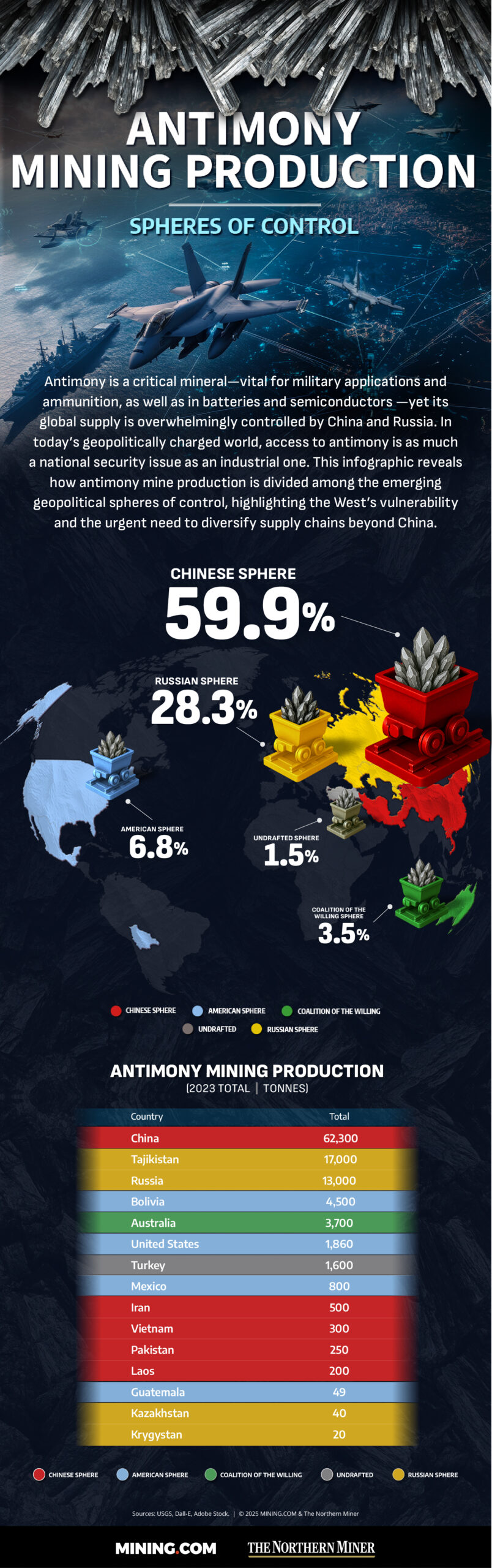

News of the partnership comes as the Trump administration steps up efforts to secure a domestic supply of antimony amid increasingly tense relations with China, which the United States Geological Survey estimated last week provides 55% of the country’s antimony.

Washington last year fully permitted the Stibnite project held by Perpetua Resources (TSX, Nasdaq: PPTA) in Idaho, which is said to host one of the largest reserves outside Chinese control.

Antimony has been designated by the US as a mineral that is critical to its national and economic security. The grey-colored metal is used in a variety of high-tech and defence products, including flame-retardant materials, certain semiconductors and ammunition hardening. No antimony has been produced in the US on a commercial scale since 2016.

Direct alignment

Since the new project “directly aligns” with Washington’s strategy of building a US critical minerals supply chain, the partners have already prepared the necessary paperwork for submittal “to hopefully achieve government funding,” US Antimony CEO Gary Evans said.

Americas Gold, the largest antimony producer in the US, will get the opportunity to become a significant player in the downstream antimony market “and realize value being left on the table under our current offtake terms for by-product antimony” contained in silver concentrate, CEO Paul Huet said in the statement.

“All minerals being mined by Americas [Gold] are deemed ‘critical,’” Evans said. “As we all know, our country is playing ‘catch-up’ today with our adversaries and we are combining today both of our financial and management resources to more quickly make advancements in the US based critical mineral space.”

Dual triggers

The new processing plant is expected to take 18 months to build, with both partners contributing capital based on their respective ownership stakes, Americas said. Neither partner said how much the new plant might cost.

After 18 months, Americas Gold can trigger its right to buy out its partner at the higher of fair market value and 120% of US Antimony’s capital contributions. US Antimony, for its part, can trigger its right to sell out under certain conditions.

The Idaho property that will house the new facility has already obtained all necessary primary permits, except for construction permits.

Under the terms of the agreement, Americas Gold will sell antimony feed material mined from the Galena complex to the JV on market terms. It will also capture 51% of the profits from the processing side of the JV business.

US Antimony, whose namesake metal is used to harden bullets, will buy the antimony produced by the JV at market terms. The company owns an antimony oxide smelter in Thompson Falls, Montana, near the border with Idaho.

Dallas-based US Antimony last year was awarded a $245 million contract from the US Defense Logistics Agency to supply antimony metal ingots for the national defense stockpile. The contact win came a few weeks after the company appointed retired four-star US Army general Jack Keane to its board.

Americas Gold shares rose 2.7% to C$11.15 Tuesday morning in Toronto, giving the company a market value of about C$3.6 billion ($2.7 billion). US Antimony rose 1.8% to $8.38 in New York for a market value of about $1.2 billion.